Lithium-Ion Battery Dispersant Market by Type (Block Co-Polymers, Naphthalene Sulfonates, Lignosulfonates, Others), End-Use (Consumer Electronics, Military, Electric Vehicles, Industrial, Others) and Region - Global Forecast to 2027

Updated on : April 23, 2024

Lithium Ion Battery Dispersant Market

The Lithium Ion Battery Dispersant Market was valued at USD 735 million in 2022 and is projected to reach USD 1,285 million by 2027, growing at 11.8% cagr from 2022 to 2027. Lithium-ion battery dispersant being an additive that increases the efficiency of lithium-ion battery and these batteries being used in various end-use industry is driving the market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on Lithium Ion Battery Dispersant Market

The COVID-19 pandemic brought the production of almost most of the major economies to a halt. The outbreak of the COVID-19 pandemic and its subsequent waves resulted in the temporary shutdown of production plants and related activities in most of the major economies across the globe. Most countries worldwide resorted to nationwide lockdown to control the spread of the virus. It slowed down the growth of various sectors and disrupted the global supply chains, consequently affecting the growth of the lithium-ion battery dispersant. Limited transportation, travel restrictions, and halt of manufacturing activities have hampered the growth of the lithium-ion battery dispersant market.

Lithium Ion Battery Dispersant Market Dynamics

Driver: Increasing demand for new technology in lithium-ion battery

Lithium-ion batteries are a major component of electric vehicles. In recent years, there has been a significant increase in the demand for electric vehicles (EVs) and plug-in hybrid electric vehicles (PHEVs), which has enhanced the demand for lithium-ion batteries. Growth in the sale of electric vehicles will positively impact the demand for lithium-ion battery dispersants.

There is a constant growth in the sale of electric vehicles due to some major advantages of electric vehicles over fuel combustion engines, such as reduced use of hazardous oil waste, less need to maintain the vehicle engine, reduction in pollution, and development of improved battery technologies. These factors will drive the growth of electric vehicles, creating the market for lithium-ion batteries. This will eventually increase the market for lithium-ion battery dispersant.

Restraints: Safety related to battery usage

Used lithium-ion batteries have hazardous chemicals such as acids, mercury, lead, and heavy metals. These chemicals can create huge damage to a person and the environment. Thus, it is compulsory to keep spent batteries in watertight containers and store them away from other flammable and combustible materials as it can easily lead to fire incidents. Some batteries are small enough to be ingested or swallowed; thus, they should be stored safely. Large lithium-based batteries, such as those used for automotive applications, can be mistaken for lead-acid batteries if inappropriately labeled by local battery manufacturers. Thus, issues related to lithium-ion batteries will also restrain the lithium-ion battery dispersant market.

Opportunity: Declining price of lithium-ion batteries

Recent developments and claims made by lithium-ion battery manufacturing companies and automobile companies suggest that the price of these batteries is expected to decline substantially. Tesla Motors Inc. (US) has begun construction of its Gigafactory 1, a lithium-ion battery factory, which is expected to help bring down the cost of lithium-ion batteries. Developments such as manufacturing on a large scale, the declining price of components, and the adoption of advanced technologies to boost battery capacity are some of the factors leading to a decline in the price of lithium-ion batteries, creating the market for lithium-ion battery dispersant.

Challenge: Overheating of lithium-ion battery

Lithium-ion batteries are used in consumer electronics, automobiles, electrical systems, commercial aviation, automated guided vehicle (AGVs), forklifts, pallet trucks, and material-handling equipment. While lithium-ion batteries can store a relatively large amount of energy in a small space, they tend to heat up quickly and may catch fire in case of malfunction. This is a challenge faced by end-use industry of lithium-ion battery market. Such issues will also create a negative impact on the demand for lithium-ion battery dispersants market.

Based on dispersant type, naphthalene sulfonate segment is the fastest growing market during the forecast period

The naphthalene sulfonate segment is fastest growing market during the forecasted period, in terms of value. The dispersant type provides optimum carbon dispersing so as to increase the efficiency of lithium-ion battery. Thus, with growth in the usage of lithium-ion batteries in sectors such as motor vehicles, smartphones sector, and rapid industrialization in developing countries there will be high growth in demand for lithium-ion battery dispersant.

Based on end-use, Industrial segments is the second largest in market during 2021

Lithium-ion batteries are used in industries such as the power, medical, and aerospace sector. These batteries are used in the energy storage system in the power sector. Along with growing industrialization and population, there is an increase in the demand for electricity which will enhance the usage of lithium-ion batteries in the power sector. This will fuel the growth in demand for lithium-ion battery dispersant.

Asia Pacific is the largest lithium-ion battery market in terms of value

Asia Pacific accounted for the largest share followed by Europe, in terms of value, in 2021. Asia Pacific is one of the major countries in the region, investing significantly in producing commercial electric vehicles with export plans. OEMs such as BYD plan to open plants in other parts of the world to manufacture electric buses and electric trucks to meet regional demand. The country supports EV usage by offering a subsidy for buying EVs. This will enhance the market for lithium-ion batteries in the region. This drives the market for lithium-ion battery dispersant.

To know about the assumptions considered for the study, download the pdf brochure

Lithium Ion Battery Dispersant Market Players

Major companies in the lithium-ion battery dispersant market include Ashland (US), Kao Corporation (Japan), LG Chem (South Korea), Toyocolor Co., Ltd. (Japan), The Lubrizol Corporation (US), Croda International PLC (UK), Borregaard AS (Norway). A total of 7 major players have been covered. These players have adopted new product launches, and new product developments as the major strategies to consolidate their position in the market.

Lithium Ion Battery Dispersant Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 735 Million |

|

Revenue Forecast in 2027 |

USD 1,285 Million |

|

CAGR |

11.8% |

|

Market Size Available for Years |

2018-2027 |

|

Base Year Considered |

2021 |

|

Forecast Period |

2022-2027 |

|

Forecast Units |

Value (USD Million) |

|

Segments Covered |

Dispersant Type, End-Use, and Region |

|

Geographies Covered |

Asia Pacific, North America, Europe, Rest Of World |

|

Companies Covered |

The major market players include Ashland (US), Kao Corporation (Japan), LG Chem (South Korea), Toyocolor Co., Ltd. (Japan), The Lubrizol Corporation (US), Croda International PLC (UK), Borregaard AS (Norway). |

This research report categorizes the lithium-ion battery dispersant market based on Dispersant Type, End-Use, and Region.

Lithium Ion Battery Dispersant Market based on Dispersant Type:

- Block Co-polymers

- Naphthalene sulfonates

- Lignosulfonates

- Others

Lithium Ion Battery Dispersant Market based on End-Use:

- Consumer Electronics

- Electric Vehicles

- Military

- Industrial

- Others

Lithium Ion Battery Dispersant Market based on Region:

- Asia Pacific

- North America

- Europe

- Rest of World

Recent Developments in Lithium Ion Battery Dispersant Market

- In 2020, Croda International PLC launched a new product, Hypermer Volt 4000T, a conductive carbon dispersant that improves battery capacity to meet electrification challenges across a range of industries, specifically focused on the automotive industry.

Frequently Asked Questions (FAQ):

What is the current size of the global lithium-ion battery dispersant market?

The lithium-ion battery dispersant market is projected to grow from USD 735 million in 2022 to USD 1,285 million by 2027, at a CAGR of 11.8% during the forecast period.

Who are the leading players in the global lithium-ion battery dispersant market?

The key players operating in the lithium-ion battery dispersant market are Ashland (US), Kao Corporation (Japan), LG Chem (South Korea), Toyocolor Co., Ltd. (Japan), The Lubrizol Corporation (US), Croda International PLC (UK), Borregaard AS (Norway). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 22)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 LITHIUM-ION BATTERY DISPERSANT MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.4 INCLUSIONS & EXCLUSIONS

1.4.1 LITHIUM-ION BATTERY DISPERSANT MARKET, BY REGION: INCLUSIONS & EXCLUSIONS

1.4.2 YEARS CONSIDERED

1.5 CURRENCY

1.6 RESEARCH LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 26)

2.1 RESEARCH DATA

FIGURE 1 LITHIUM-ION BATTERY DISPERSANT MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

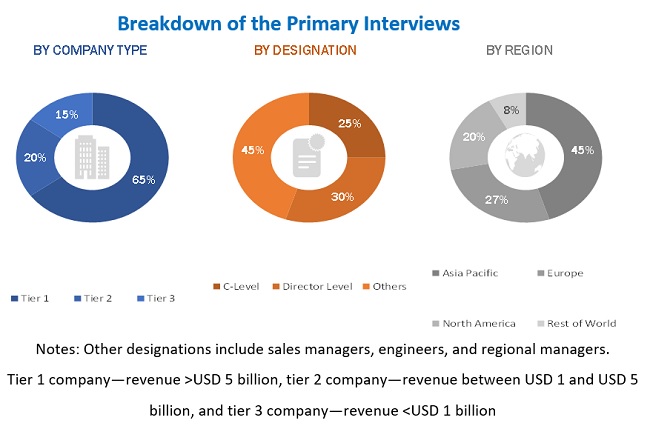

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primary interviews

2.2 DEMAND-SIDE MATRIX

FIGURE 2 MAIN MATRIX CONSIDERED FOR CONSTRUCTING AND ASSESSING DEMAND FOR LITHIUM-ION BATTERY DISPERSANT

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 5 METHODOLOGY FOR SUPPLY-SIDE SIZING OF LITHIUM-ION BATTERY DISPERSANT MARKET

FIGURE 6 METHODOLOGY FOR SUPPLY-SIDE SIZING OF LITHIUM-ION BATTERY DISPERSANTS MARKET (2/2)

2.3.2.1 Calculations for supply-side analysis

2.3.2.2 Forecast

2.4 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

2.5 DATA TRIANGULATION

FIGURE 7 LITHIUM-ION BATTERY DISPERSANT MARKET: DATA TRIANGULATION

2.6 KEY ASSUMPTIONS WHILE CALCULATING DEMAND-SIDE MARKET SIZE

2.7 LIMITATIONS

2.8 RISK ANALYSIS

3 EXECUTIVE SUMMARY (Page No. - 34)

TABLE 1 LITHIUM-ION BATTERY DISPERSANT MARKET

FIGURE 8 BLOCK COPOLYMER SEGMENT BY DISPERSANT TYPE TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

FIGURE 9 ELECTRIC VEHICLES BY END-USE ESTIMATED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

FIGURE 10 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF LITHIUM-ION BATTERY DISPERSANT MARKET, BY VALUE IN 2021

4 PREMIUM INSIGHTS (Page No. - 37)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN LITHIUM-ION BATTERY DISPERSANT MARKET

FIGURE 11 LITHIUM-ION BATTERY DISPERSANTS MARKET PROJECTED TO WITNESS MODERATE GROWTH DURING FORECAST PERIOD

4.2 LITHIUM-ION BATTERY DISPERSANT MARKET, BY REGION

FIGURE 12 ASIA PACIFIC TO ACCOUNT FOR LARGEST SHARE OF LITHIUM-ION BATTERY DISPERSANT DURING FORECAST PERIOD

4.3 LITHIUM-ION BATTERY DISPERSANTS MARKET, BY DISPERSANT TYPE

FIGURE 13 BLOCK COPOLYMERS ACCOUNTED FOR LARGEST MARKET SHARE BY VALUE IN 2021

4.4 LITHIUM-ION BATTERY DISPERSANT MARKET, BY END-USE

FIGURE 14 OTHERS SEGMENT IS EXPECTED TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 39)

5.1 INTRODUCTION

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN LITHIUM-ION BATTERY DISPERSANT MARKET

5.1.1 DRIVERS

5.1.1.1 Increase in demand for LFP and NMC chemistry type lithium-ion battery in plug-in vehicles

5.1.1.2 Growing need for automation and lithium-ion battery-operated material handling equipment in industries

5.1.1.3 Development of smart devices and other industrial goods using lithium-ion batteries

5.1.1.4 Growing adoption of lithium-ion batteries in renewable energy storage

FIGURE 16 IMPACT OF DRIVERS ON LITHIUM-ION BATTERY DISPERSANT MARKET

5.1.2 RESTRAINTS

5.1.2.1 Safety issues related to storage and transportation of spent batteries

FIGURE 17 IMPACT OF RESTRAINTS ON LITHIUM-ION BATTERY DISPERSANT MARKET

5.1.3 OPPORTUNITIES

5.1.3.1 Declining prices of lithium-ion batteries increase adoption rate in new applications

5.1.3.2 Growing number of R&D initiatives by manufacturers for improvements in Li-ion batteries

FIGURE 18 IMPACT OF OPPORTUNITIES ON LITHIUM-ION BATTERY DISPERSANT MARKET

5.1.4 CHALLENGES

5.1.4.1 Disruption in supply chain of batteries and related components due to COVID-19

5.1.4.2 Overheating of lithium-ion batteries

FIGURE 19 IMPACT OF CHALLENGES ON LITHIUM-ION BATTERY DISPERSANT MARKET

5.2 PORTER'S FIVE FORCES ANALYSIS

FIGURE 20 LITHIUM-ION BATTERY DISPERSANT MARKET: PORTER'S FIVE FORCES ANALYSIS

TABLE 2 LITHIUM-ION BATTERY DISPERSANTS MARKET: PORTER'S FIVE FORCES ANALYSIS

5.2.1 BARGAINING POWER OF SUPPLIERS

5.2.2 THREAT OF NEW ENTRANTS

5.2.3 THREAT OF SUBSTITUTES

5.2.4 BARGAINING POWER OF BUYERS

5.2.5 INTENSITY OF COMPETITIVE RIVALRY

5.3 TECHNOLOGY ANALYSIS

5.4 PRICING ANALYSIS

TABLE 3 AVERAGE PRICE OF LITHIUM-ION BATTERY DISPERSANT 2022

5.5 CASE STUDY ANALYSIS

5.5.1 CHALLENGE: USING COMPANY'S DISTINCTIVE TECHNOLOGIES TO MANUFACTURE CARBON DISPERSANTS FOR IMPROVED BATTERY CAPACITY

5.6 ECOSYSTEM/MARKET MAP

FIGURE 21 LITHIUM-ION BATTERY DISPERSANT MARKET: ECOSYSTEM/MARKET MAP

TABLE 4 LITHIUM-ION BATTERY DISPERSANTS MARKET: ECOSYSTEM

5.7 VALUE CHAIN

FIGURE 22 LITHIUM-ION BATTERY DISPERSANTS MARKET: VALUE CHAIN

5.8 TRADE DATA

TABLE 5 IMPORT DATA OF LITHIUM CELLS AND BATTERIES

TABLE 6 EXPORT DATA OF LITHIUM CELLS AND BATTERIES

5.9 REGULATORY LANDSCAPE

TABLE 7 REGULATIONS AND STANDARDS FOR BATTERIES

6 LITHIUM-ION BATTERY DISPERSANT PATENT ANALYSIS (Page No. - 52)

6.1 INTRODUCTION

6.2 METHODOLOGY

6.3 DOCUMENT TYPE

FIGURE 23 NUMBER OF GRANTED PATENTS AND PATENT APPLICATION

FIGURE 24 PUBLICATION TRENDS - LAST 10 YEARS

6.4 INSIGHT

FIGURE 25 LEGAL STATUS OF PATENTS

6.5 JURISDICTION ANALYSIS

FIGURE 26 TOP JURISDICTION- BY DOCUMENT

6.6 TOP COMPANIES/APPLICANTS

FIGURE 27 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

TABLE 8 LIST OF PATENTS

TABLE 9 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

7 LITHIUM-ION BATTERY DISPERSANT MARKET, BY DISPERSANT TYPE (Page No. - 57)

7.1 INTRODUCTION

FIGURE 28 BLOCK COPOLYMERS SEGMENT TO HOLD SIGNIFICANT SHARE DURING FORECAST PERIOD

TABLE 10 LITHIUM-ION BATTERY DISPERSANT MARKET SIZE, BY DISPERSANT TYPE, 2018–2021 (USD MILLION)

TABLE 11 LITHIUM-ION BATTERY DISPERSANTS MARKET SIZE, BY DISPERSANT TYPE, 2022–2027 (USD MILLION)

7.2 BLOCK COPOLYMERS

7.2.1 RISING PRODUCTION OF ELECTRIC VEHICLES TO CREATE POSITIVE IMPACT ON GROWTH FOR THIS SEGMENT

7.3 NAPHTHALENE SULFONATES

7.3.1 SPIRALING DEMAND FOR CONSUMER ELECTRONICS IN KEY COUNTRIES TO BOOST MARKET FOR THIS SEGMENT

7.4 LIGNOSULFONATE

7.4.1 GROWING DEMAND FOR LIGNOSULFONATE IN ASIA PACIFIC IS EXPECTED TO BOLSTER THIS SEGMENT

7.5 OTHERS

8 LITHIUM-ION BATTERY DISPERSANT MARKET, BY END-USE (Page No. - 61)

8.1 INTRODUCTION

FIGURE 29 ELECTRIC VEHICLES SEGMENT TO HOLD SIGNIFICANT SHARE DURING FORECAST PERIOD

TABLE 12 LITHIUM-ION BATTERY DISPERSANT MARKET SIZE, BY END-USE, 2018–2021 (USD MILLION)

TABLE 13 LITHIUM-ION BATTERY DISPERSANTS MARKET SIZE, BY END-USE, 2022–2027 (USD MILLION)

8.2 CONSUMER ELECTRONICS

8.2.1 BURGEONING DEMAND FOR CONSUMER ELECTRONICS SUCH AS DRONES TO BOLSTER CONSUMER ELECTRONICS SEGMENT

TABLE 14 CONSUMER ELECTRONICS: LITHIUM-ION BATTERY DISPERSANT MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 15 CONSUMER ELECTRONICS: LITHIUM-ION BATTERY DISPERSANTS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8.3 MILITARY

8.3.1 GROWING APPLICATION OF LITHIUM-ION BATTERIES IN MILITARY EQUIPMENT TO BOOST MARKET FOR THIS SEGMENT

TABLE 16 MILITARY: LITHIUM-ION BATTERY DISPERSANT MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 17 MILITARY: LITHIUM-ION BATTERY DISPERSANT MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8.4 ELECTRIC VEHICLES

8.4.1 RISING DEMAND FOR ELECTRIC VEHICLES TO BOLSTER THIS SEGMENT

TABLE 18 ELECTRIC VEHICLES: LITHIUM-ION BATTERY DISPERSANT MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 19 ELECTRIC VEHICLES: LITHIUM-ION BATTERY DISPERSANTS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8.5 INDUSTRIAL

8.5.1 GROWING INDUSTRIALIZATION TO PROPEL INDUSTRIAL SEGMENT

TABLE 20 INDUSTRIAL: LITHIUM-ION BATTERY DISPERSANT MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 21 INDUSTRIAL: LITHIUM-ION BATTERY DISPERSANT MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8.6 OTHERS

TABLE 22 OTHERS: LITHIUM-ION BATTERY DISPERSANT MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 23 OTHERS: LITHIUM-ION BATTERY DISPERSANT MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9 LITHIUM-ION BATTERY DISPERSANT MARKET, BY REGION (Page No. - 68)

9.1 INTRODUCTION

FIGURE 30 ASIA PACIFIC TO BE LARGEST LITHIUM-ION BATTERY DISPERSANT MARKET DURING FORECAST PERIOD

TABLE 24 GLOBAL: LITHIUM-ION BATTERY DISPERSANT MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 25 GLOBAL: LITHIUM-ION BATTERY DISPERSANT MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 31 NORTH AMERICA: LITHIUM-ION BATTERY DISPERSANT MARKET SNAPSHOT

TABLE 26 NORTH AMERICA: LITHIUM-ION BATTERY DISPERSANTS MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 27 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 28 NORTH AMERICA: MARKET SIZE, BY END-USE, 2018–2021 (USD MILLION)

TABLE 29 NORTH AMERICA: MARKET SIZE, BY END-USE, 2022–2027 (USD MILLION)

TABLE 30 NORTH AMERICA: MARKET SIZE, BY CONSUMER ELECTRONICS, 2018–2021 (USD MILLION)

TABLE 31 NORTH AMERICA: MARKET SIZE, BY CONSUMER ELECTRONICS, 2022–2027 (USD MILLION)

TABLE 32 NORTH AMERICA: MARKET SIZE, BY ELECTRIC VEHICLES, 2018–2021 (USD MILLION)

TABLE 33 NORTH AMERICA: MARKET SIZE, BY ELECTRIC VEHICLES, 2022–2027 (USD MILLION)

TABLE 34 NORTH AMERICA: MARKET SIZE, BY MILITARY, 2018–2021 (USD MILLION)

TABLE 35 NORTH AMERICA: MARKET SIZE, BY MILITARY, 2022–2027 (USD MILLION)

TABLE 36 NORTH AMERICA: MARKET SIZE, BY INDUSTRIAL, 2018–2021 (USD MILLION)

TABLE 37 NORTH AMERICA: MARKET SIZE, BY INDUSTRIAL, 2022–2027 (USD MILLION)

TABLE 38 NORTH AMERICA: MARKET SIZE, BY OTHERS, 2018–2021 (USD MILLION)

TABLE 39 NORTH AMERICA: MARKET SIZE, BY OTHERS, 2022–2027 (USD MILLION)

9.2.1 US

9.2.1.1 Growing use of lithium-ion batteries in region to drive market

TABLE 40 US: LITHIUM-ION BATTERY DISPERSANT MARKET SIZE, BY END-USE, 2018–2021 (USD MILLION)

TABLE 41 US: LITHIUM-ION BATTERY DISPERSANTS MARKET SIZE, BY END-USE, 2022–2027 (USD MILLION)

9.2.2 CANADA

9.2.2.1 Government investment in electric vehicles to fuel demand

TABLE 42 CANADA: LITHIUM-ION BATTERY DISPERSANT MARKET SIZE, BY END-USE, 2018–2021 (USD MILLION)

TABLE 43 CANADA: LITHIUM-ION BATTERY DISPERSANTS MARKET SIZE, BY END-USE, 2022–2027 (USD MILLION)

9.2.3 MEXICO

9.2.3.1 Rising demand for lithium-ion batteries to enhance market

TABLE 44 MEXICO: LITHIUM-ION BATTERY DISPERSANT MARKET SIZE, BY END-USE, 2018–2021 (USD MILLION)

TABLE 45 MEXICO: LITHIUM-ION BATTERY DISPERSANTS MARKET SIZE, BY END-USE, 2022–2027 (USD MILLION)

9.3 ASIA PACIFIC

FIGURE 32 ASIA PACIFIC: LITHIUM-ION BATTERY DISPERSANT MARKET SNAPSHOT

TABLE 46 ASIA PACIFIC: LITHIUM-ION BATTERY DISPERSANTS MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 47 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 48 ASIA PACIFIC: MARKET SIZE, BY END-USE, 2018–2021 (USD MILLION)

TABLE 49 ASIA PACIFIC: MARKET SIZE, BY END-USE, 2022–2027 (USD MILLION)

TABLE 50 ASIA PACIFIC: MARKET SIZE, BY CONSUMER ELECTRONICS, 2018–2021 (USD MILLION)

TABLE 51 ASIA PACIFIC: MARKET SIZE, BY CONSUMER ELECTRONICS, 2022–2027 (USD MILLION)

TABLE 52 ASIA PACIFIC: MARKET SIZE, BY ELECTRIC VEHICLES, 2018–2021 (USD MILLION)

TABLE 53 ASIA PACIFIC: MARKET SIZE, BY ELECTRIC VEHICLES, 2022–2027 (USD MILLION)

TABLE 54 ASIA PACIFIC: MARKET SIZE, BY MILITARY, 2018–2021 (USD MILLION)

TABLE 55 ASIA PACIFIC: MARKET SIZE, BY MILITARY, 2022–2027 (USD MILLION)

TABLE 56 ASIA PACIFIC: MARKET SIZE, BY INDUSTRIAL, 2018–2021 (USD MILLION)

TABLE 57 ASIA PACIFIC: MARKET SIZE, BY INDUSTRIAL, 2022–2027 (USD MILLION)

TABLE 58 ASIA PACIFIC: MARKET SIZE, BY OTHERS, 2018–2021 (USD MILLION)

TABLE 59 ASIA PACIFIC: MARKET SIZE, BY OTHERS, 2022–2027 (USD MILLION)

9.3.1 CHINA

9.3.1.1 Growing Chinese economy to enhance market demand

TABLE 60 CHINA: LITHIUM-ION BATTERY DISPERSANT MARKET SIZE, BY END-USE, 2018–2021 (USD MILLION)

TABLE 61 CHINA: LITHIUM-ION BATTERY DISPERSANTS MARKET SIZE, BY END-USE, 2022–2027 (USD MILLION)

9.3.2 JAPAN

9.3.2.1 Presence of key lithium-ion battery manufacturers to drive demand

TABLE 62 JAPAN: LITHIUM-ION BATTERY DISPERSANT MARKET SIZE, BY END-USE, 2018–2021 (USD MILLION)

TABLE 63 JAPAN: LITHIUM-ION BATTERY DISPERSANTS MARKET SIZE, BY END-USE, 2022–2027 (USD MILLION)

9.3.3 SOUTH KOREA

9.3.3.1 Government initiatives to increase production of electric vehicles to propel

TABLE 64 SOUTH KOREA: LITHIUM-ION BATTERY DISPERSANT MARKET SIZE, BY END-USE, 2018–2021 (USD MILLION)

TABLE 65 SOUTH KOREA: LITHIUM-ION BATTERY DISPERSANTS MARKET SIZE, BY END-USE, 2022–2027 (USD MILLION)

9.3.4 REST OF ASIA PACIFIC

TABLE 66 REST OF ASIA PACIFIC: LITHIUM-ION BATTERY DISPERSANT MARKET SIZE, BY END-USE, 2018–2021 (USD MILLION)

TABLE 67 REST OF ASIA PACIFIC: LITHIUM-ION BATTERY DISPERSANTS MARKET SIZE, BY END-USE, 2022–2027 (USD MILLION)

9.4 EUROPE

FIGURE 33 EUROPE: LITHIUM-ION BATTERY DISPERSANT MARKET SNAPSHOT

TABLE 68 EUROPE: LITHIUM-ION BATTERY DISPERSANTS MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 69 EUROPE: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 70 EUROPE: MARKET SIZE, BY END-USE, 2018–2021 (USD MILLION)

TABLE 71 EUROPE: MARKET SIZE, BY END-USE, 2022–2027 (USD MILLION)

TABLE 72 EUROPE: MARKET SIZE, BY CONSUMER ELECTRONICS, 2018–2021 (USD MILLION)

TABLE 73 EUROPE: MARKET SIZE, BY CONSUMER ELECTRONICS, 2022–2027 (USD MILLION)

TABLE 74 EUROPE: MARKET SIZE, BY ELECTRIC VEHICLES, 2018–2021 (USD MILLION)

TABLE 75 EUROPE: MARKET SIZE, BY ELECTRIC VEHICLES, 2022–2027 (USD MILLION)

TABLE 76 EUROPE: MARKETS SIZE, BY MILITARY, 2018–2021 (USD MILLION)

TABLE 77 EUROPE: MARKET SIZE, BY MILITARY, 2022–2027 (USD MILLION)

TABLE 78 EUROPE: MARKET SIZE, BY INDUSTRIAL, 2018–2021 (USD MILLION)

TABLE 79 EUROPE: MARKET SIZE, BY INDUSTRIAL, 2022–2027 (USD MILLION)

TABLE 80 EUROPE: MARKET SIZE, BY OTHERS, 2018–2021 (USD MILLION)

TABLE 81 EUROPE: MARKET SIZE, BY OTHERS, 2022–2027 (USD MILLION)

9.4.1 GERMANY

9.4.1.1 Booming automotive industry and increasing developments in consumer electronics industry

TABLE 82 GERMANY: LITHIUM-ION BATTERY DISPERSANT MARKET SIZE, BY END-USE, 2018–2021 (USD MILLION)

TABLE 83 GERMANY: LITHIUM-ION BATTERY DISPERSANTS MARKET SIZE, BY END-USE, 2022–2027 (USD MILLION)

9.4.2 FRANCE

9.4.2.1 Growth of electric vehicles and growing military expenditure to propel demand

TABLE 84 FRANCE: LITHIUM-ION BATTERY DISPERSANT MARKET SIZE, BY END-USE, 2018–2021 (USD MILLION)

TABLE 85 FRANCE: LITHIUM-ION BATTERY DISPERSANTS MARKET SIZE, BY END-USE, 2022–2027 (USD MILLION)

9.4.3 REST OF EUROPE

TABLE 86 REST OF EUROPE: LITHIUM-ION BATTERY DISPERSANT MARKET SIZE, BY END-USE, 2018–2021 (USD MILLION)

TABLE 87 REST OF EUROPE: LITHIUM-ION BATTERY DISPERSANTS MARKET SIZE, BY END-USE, 2022–2027 (USD MILLION)

9.5 REST OF WORLD

TABLE 88 REST OF WORLD: LITHIUM-ION BATTERY DISPERSANT MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 89 REST OF WORLD: LITHIUM-ION BATTERY DISPERSANTS MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 90 REST OF WORLD: MARKET SIZE, BY END-USER, 2018–2021 (USD MILLION)

TABLE 91 REST OF WORLD: MARKET SIZE, BY END-USE, 2022–2027 (USD MILLION)

TABLE 92 REST OF WORLD: MARKET SIZE, BY CONSUMER ELECTRONICS, 2018–2021 (USD MILLION)

TABLE 93 REST OF WORLD: MARKET SIZE, BY CONSUMER ELECTRONICS, 2022–2027 (USD MILLION)

TABLE 94 REST OF WORLD: MARKET SIZE, BY ELECTRIC VEHICLES, 2018–2021 (USD MILLION)

TABLE 95 REST OF WORLD: MARKET SIZE, BY ELECTRIC VEHICLES, 2022–2027 (USD MILLION)

TABLE 96 REST OF WORLD: MARKET SIZE, BY MILITARY, 2018–2021 (USD MILLION)

TABLE 97 REST OF WORLD: MARKET SIZE, BY MILITARY, 2022–2027 (USD MILLION)

TABLE 98 REST OF WORLD: MARKET SIZE, BY INDUSTRIAL, 2018–2021 (USD MILLION)

TABLE 99 REST OF WORLD: MARKET SIZE, BY INDUSTRIAL, 2022–2027 (USD MILLION)

TABLE 100 REST OF WORLD: MARKET SIZE, BY OTHERS, 2018–2021 (USD MILLION)

TABLE 101 REST OF WORLD: MARKET SIZE, BY OTHERS, 2022–2027 (USD MILLION)

9.5.1 MIDDLE EAST & AFRICA

9.5.1.1 Shift toward electric vehicles to drive market

TABLE 102 MIDDLE EAST & AFRICA: LITHIUM-ION BATTERY DISPERSANT MARKET SIZE, BY END-USE, 2018–2021 (USD MILLION)

TABLE 103 MIDDLE EAST & AFRICA: LITHIUM-ION BATTERY DISPERSANTS MARKET SIZE, BY END-USE, 2022–2027 (USD MILLION)

9.5.2 SOUTH AMERICA

9.5.2.1 Government spending on military expenditure and electric vehicle infrastructure to boost market

TABLE 104 SOUTH AMERICA: LITHIUM-ION BATTERY DISPERSANT MARKET SIZE, BY END-USE, 2018–2021 (USD MILLION)

TABLE 105 SOUTH AMERICA: LITHIUM-ION BATTERY DISPERSANTS MARKET SIZE, BY END-USE, 2022–2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 101)

10.1 INTRODUCTION

10.2 LIST OF LEADING PLAYERS, 2021

FIGURE 34 LIST OF LEADING PLAYERS IN LITHIUM-ION BATTERY DISPERSANT MARKET, 2021

10.3 COMPANY PRODUCT FOOTPRINT ANALYSIS

TABLE 106 COMPANY TOTAL FOOTPRINT

TABLE 107 COMPANY APPLICATION FOOTPRINT

TABLE 108 COMPANY REGION FOOTPRINT

10.4 COMPANY EVALUATION QUADRANT

10.4.1 STARS

10.4.2 EMERGING LEADERS

10.4.3 PERVASIVE PLAYERS

10.4.4 PARTICIPANTS

FIGURE 35 LITHIUM-ION BATTERY DISPERSANT MARKET COMPETITIVE LEADERSHIP MAPPING, 2022

10.5 COMPETITIVE SCENARIO

10.5.1 PRODUCT LAUNCHES

TABLE 109 PRODUCT LAUNCHES, 2019–2022

11 COMPANY PROFILES (Page No. - 106)

11.1 INTRODUCTION

11.2 KEY PLAYERS

(Business Overview, Products/solutions/services offered, Recent Developments, Product launch, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats)*

11.2.1 CRODA INTERNATIONAL PLC

TABLE 110 CRODA INTERNATIONAL PLC: COMPANY OVERVIEW

FIGURE 36 CRODA INTERNATIONAL PLC: COMPANY SNAPSHOT

TABLE 111 CRODA INTERNATIONAL PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 112 CRODA INTERNATIONAL PLC: PRODUCT LAUNCHES

11.2.2 KAO CORPORATION

TABLE 113 KAO CORPORATION: COMPANY OVERVIEW

FIGURE 37 KAO CORPORATION: COMPANY SNAPSHOT

TABLE 114 KAO CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

11.2.3 ASHLAND

TABLE 115 ASHLAND: COMPANY OVERVIEW

FIGURE 38 ASHLAND: COMPANY SNAPSHOT

TABLE 116 ASHLAND: PRODUCTS/SOLUTIONS/SERVICES OFFERED

11.2.4 TOYOCOLOR CO., LTD.

TABLE 117 TOYOCOLOR CO., LTD.: COMPANY OVERVIEW

TABLE 118 TOYOCOLOR CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

11.2.5 BORREGAARD AS

TABLE 119 BORREGAARD AS: COMPANY OVERVIEW

FIGURE 39 BORREGAARD AS: COMPANY SNAPSHOT

TABLE 120 BORREGAARD AS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

11.2.6 LG CHEM

TABLE 121 LG CHEM: COMPANY OVERVIEW

FIGURE 40 LG CHEM: COMPANY SNAPSHOT

TABLE 122 LG CHEM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

11.2.7 THE LUBRIZOL CORPORATION

TABLE 123 THE LUBRIZOL CORPORATION: COMPANY OVERVIEW

TABLE 124 THE LUBRIZOL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

*Details on Business Overview, Products Offered, Recent Developments, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 121)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGESTORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATION

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

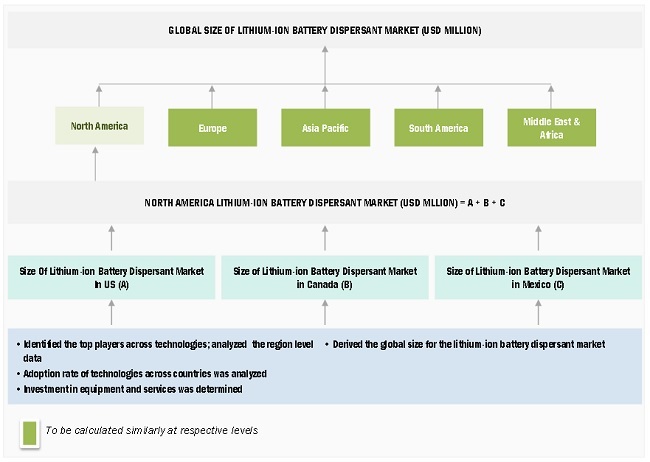

The study involved four major activities in estimating the current size of the lithium-ion battery dispersant market. Exhaustive secondary research was done to collect information on the market, peer markets, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the lithium-ion battery dispersant value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Lithium-Ion Battery Dispersant Market Secondary Research

Secondary sources for this research study include annual reports; press releases, and investor presentations of companies; white papers; certified publications; and articles by recognized authors, gold- and silver-standard websites, lithium-ion battery dispersant manufacturing companies, regulatory bodies, trade directories, and databases. The secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. It has also been used to obtain information about key developments from a market-oriented perspective.

Lithium-Ion Battery Dispersant Market Primary Research

The lithium-ion battery dispersant market comprises several stakeholders, such as raw material suppliers, processors, end-use industries, and regulatory organizations in the supply chain. The demand side of the market is characterized by the presence of lithium-ion battery dispersant manufacturers, importers/exporters, and manufacturers engaged in the production of various products. The supply side is characterized by key technology providers for lithium-ion battery dispersant, end-users, researchers, and service providers.

In the primary research process, various primary sources from the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side included key opinion leaders, executives, vice presidents, and CEOs of construction companies. The primary sources from the supply side included research institutions involved in R&D activities to introduce new technologies, key opinion leaders, distributors, and lithium-ion battery dispersant manufacturing companies.

To know about the assumptions considered for the study, download the pdf brochure

Lithium-Ion Battery Dispersant Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the total size of the lithium-ion battery dispersant market. These approaches have also been used extensively to estimate the size of various dependent subsegments of the market. The research methodology used to estimate the market size included the following:

The following segments provide details about the overall market size estimation process employed in this study

- The key players in the market were identified through secondary research.

- The market shares in the respective regions were identified through primary and secondary research.

- The value chain and market size of the lithium-ion battery dispersant market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of annual and financial reports of the top market players and interviews with industry experts, such as CEOs, VPs, directors, sales managers, and marketing executives, for key insights, both quantitative and qualitative.

Global Lithium-Ion Battery Dispersant Battery Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Lithium-Ion Battery Dispersant Market Data Triangulation

After arriving at the overall market size from the estimation process explained below, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market was validated using both the top-down and bottom-up approaches.

Lithium-Ion Battery Dispersant Market Report Objectives

Lithium-Ion Battery Dispersant Market Market Intelligence

- To define, describe, and forecast the lithium-ion battery dispersant market in terms of value

- To provide detailed information regarding the main factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To forecast the market size based on dispersant type and end-use of lithium-ion battery dispersant

- To forecast the size of the market with respect to four main regions—North America, Europe, Asia Pacific, and the Rest of World (the Middle East & Africa and South America)

- To provide the post-pandemic estimation of the lithium-ion battery dispersant market size and analyze the impact of the outbreak of the COVID-19 on the market

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

- To analyze the competitive developments such as new product launches in the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies.

Competitive Intelligence

- To identify and profile the key players in the lithium-ion battery dispersant market

- To determine the top players offering various products in the lithium-ion battery dispersant market

- To provide a comparative analysis of the market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- To understand the competitive landscape of the market and identify the key growth strategies adopted by the leading players across key regions

Lithium-Ion Battery Dispersant Market Report Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Lithium-Ion Battery Dispersant Market

Please provide lithium-ion battery dispersant industry report for South Korea.