Biological Wastewater Treatment Market by Process (Aerobic, Anaerobic), End-Use Industry (Municipal, Industrial (Pulp & Paper, Meat & Poultry, Chemicals, Pharmaceuticals, Others)), and Region (NA, Europe, APAC, MEA, and SA) - Global Forecast to 2025

Updated on : April 04, 2024

Biological Wastewater Treatment Market

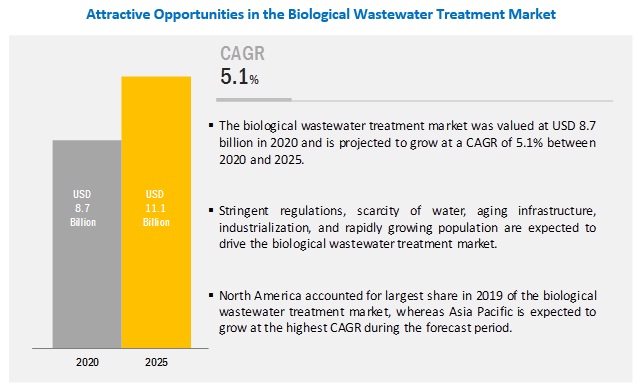

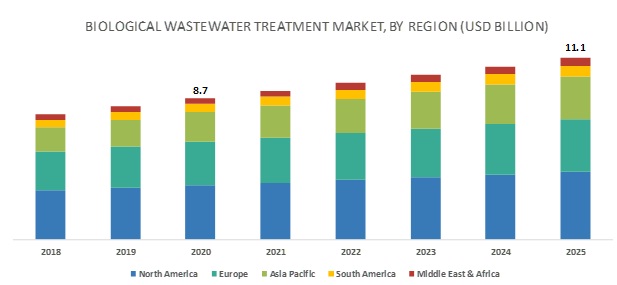

The biological wastewater treatment market was valued at USD 8.7 billion in 2020 and is projected to reach USD 11.1 billion by 2025, growing at 5.1% cagr from 2020 to 2025. Stringent regulations regarding the disposal of wastewater into the environment or for reuse, aging infrastructure, water scarcity & reusability of wastewater, rapidly growing population and industrialization are major drivers responsible for the growth of the market.

Biological Wastewater Treatment Market Dynamics

The aerobic segment is expected to lead the biological wastewater treatment market during the forecast period

Based on process, the global biological wastewater treatment market is segmented into aerobic and anaerobic. The aerobic segment accounted for a larger share in the market, while the anaerobic segment is expected to grow at a higher CAGR during the forecast period. The large share of the aerobic segment is due to its low capital cost, simple design, and efficiency.

The industrial segment is expected to account for a larger share of the biological wastewater treatment market during the forecast period

Based on end-use industry, the biological wastewater treatment market is segmented into municipal and industrial. The industrial segment includes pulp & paper, meat & poultry, chemicals, pharmaceuticals, and others. Others include textile, dairy, breweries, oil & gas, and metal. The industrial segment accounted for a larger share, owing to its ability to generate highly contaminated wastewater, which requires high biological oxygen demand for processing.

North America led the biological wastewater treatment market in 2019.

Based on region, the biological wastewater treatment market is segmented into North America, Europe, Asia Pacific, Middle East & Africa, and South America. North America accounted for the largest share of the market in 2019. This large share can be attributed to stringent regulations imposed for disposal of wastewater into environment, and the presence of various large manufacturers such as Evoqua Water Technologies LLC (US), Aquatech International (US), and Xylem Inc. (US). Aging infrastructure is also expected to fuel the growth of the market.

Biological Wastewater Treatment Market Players

Companies such as Veolia (France), and Suez Water Technologies & Solutions (France), Aquatech International (US), Evoqua Water Technologies LLC (US), Ecolab Inc. (US), Pentair plc (US), Xylem Inc. (US), Samco Technologies, Inc. (US), and Dryden Aqua Ltd. (India), and DAS Environmental Expert GmbH (Germany) are the major players in the biological wastewater treatment market. These players have been focusing on strategies such as contracts, expansions, acquisitions, new product developments & launches, and agreements that have helped them expand their businesses in untapped and potential markets. The diversified product portfolio and multiple uses are factors responsible to strengthen the positions of these companies in the biological wastewater treatment market.

Biological Wastewater Treatment Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2020 |

USD 8.7 billion |

|

Revenue Forecast in 2025 |

USD 11.1 billion |

|

CAGR |

5.1% |

|

Market size available for years |

2018-2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

Process, End-use Industry, and Region |

|

Regions covered |

North America, Europe, Asia Pacific, Middle East & Africa, and South America |

|

Companies covered |

Some of the leading players are Veolia (France), and Suez Water Technologies & Solutions (France), Aquatech International (US), Evoqua Water Technologies LLC (US), Ecolab Inc. (US), Pentair plc (US), Xylem Inc. (US), Samco Technologies, Inc. (US), and Dryden Aqua Ltd. (India), DAS Environmental Expert GmbH (Germany). |

This report categorizes the biological wastewater treatment market based on process, end-use industry, and region.

Based on process:

- Aerobic

- Anaerobic

Based on end-use industry:

- Municipal

-

Industrial

- Pulp & Paper

- Meat & Poultry

- Chemicals

- Pharmaceuticals

- Others (textile, dairy, breweries, oil & gas, metal)

Based on region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In 2019, Suez was awarded a contract by the Filanc Black & Veatch JV (FBV). It selected SUEZ’s LEAPmbr technology because it produces superior water quality, ensures reliability and value, and fits within a small footprint. In the FBV design, the MBR effluent will be further treated using reverse osmosis membranes and an advanced oxidation process before being injected into the aquifer. The new facility will treat one million gallons of wastewater per day.

- In 2018, Veolia signed a contract with the Paris government for wastewater and urban stormwater management throughout the area covered by the Métropole (Martignas-sur-Jalle excepted). The contract covers the management of six wastewater treatment plants with a total capacity of 1,156,400 population equivalents, with 4,200 km of wastewater, and urban stormwater networks for 275,000 users.

- In 2018, Aquatech International was awarded a contract for a new wastewater treatment plant for Fulcrum Bioenergy, a biorefinery plant in the US. Aquatech will supply a forced circulation crystallizer and a demineralization system. Aquatech will act as the Engineering, Procurement, and Construction (EPC) and Operations and Maintenance (O&M) on the construction of the project. The project is expected to be completed in 2019.

- In 2017, Evoqua Water Technologies LLC acquired ADI Systems (US) from ADI Group Inc. (US), a wastewater solutions company serving industrial and manufacturing sectors.

Key Questions addressed by the report

- What are the future revenue pockets in the biological wastewater treatment market?

- Which key developments are expected to have a long-term impact on the biological wastewater treatment market?

- Which process is expected to cannibalize existing markets?

- How is the current regulatory framework expected to impact the market?

- What will be the future product mix of the biological wastewater treatment equipment?

- What are the prime strategies of leaders in the biological wastewater treatment market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Primary and Secondary Research (Value Market)- Approach 1

2.1.2 Primary and Secondary Research (Value Market)- Approach 2

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Secondary Data

2.4 Primary Data

2.5 Research Assumptions and Limitations

2.5.1 Assumptions

2.5.2 Limitations

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 27)

4.1 Attractive Opportunities in Biological Wastewater Treatment Market

4.2 Market, By End-Use Industry

4.3 Market, By Process

4.4 Market, By Region

4.5 North America: Market, By Process & Country

5 Market Overview (Page No. - 30)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Aging Infrastructure, Water Scarcity, and Reusability of Water

5.2.1.2 Stringent Regulations Regarding the Disposal of Wastewater

5.2.1.3 Increase in Industrial Water Consumption and Discharge

5.2.2 Restraints

5.2.2.1 High Capital, Maintenance, and Operational Costs

5.2.2.2 Decreasing Capital Funding

5.2.3 Opportunities

5.2.3.1 Growing Demand for Sustainable, Energy-Efficient, and Advanced Wastewater Treatment Technologies

5.2.3.2 Smart Metering and Data Analysis

5.2.4 Challenges

5.2.4.1 High Energy Consumption and Environmental Footprint

5.3 Porter’s Five Forces Analysis

5.4 Bargaining Power of Suppliers

5.5 Threat of New Entrants

5.6 Threat of Substitutes

5.7 Bargaining Power of Buyers

5.8 Intensity of Competitive Rivalry

6 Biological Wastewater Treatment Market, By Process (Page No. - 38)

6.1 Introduction

6.2 Aerobic

6.2.1 Wide Application Areas, Low Capital Cost, and Efficiency is Driving the Aerobic Segment

6.3 Anaerobic

6.3.1 Low Energy Consumption and Operational and Maintenance Costs are Expected to Drive the Anaerobic Segment

7 Biological Wastewater Treatment Market, By End-Use Industry (Page No. - 42)

7.1 Introduction

7.2 Municipal

7.2.1 Majority of the Municipal Wastewater is Treated Using Chemical Oxidation, Due to the High Chemical Oxygen Demand (COD)

7.3 Industrial

7.3.1 Contaminants Or Effluents Generated in Industries are Highly Concentrated

7.4 Pulp & Paper

7.4.1 Wastewater Generated From Processing of Pulp & Paper has High Concentration of Suspended and Dissolved Solids

7.5 Meat & Poultry

7.5.1 Wastewater Generated From the Meat & Poultry Industry Consists of Total Dissolved Solids (TSS), Fat, Oil, and Grease

7.6 Chemicals

7.6.1 Biological Wastewater Treatment Equipment are Used in Chemicals Industry to Treat Produced and Discharged Wastewater

7.7 Pharmaceuticals

7.7.1 Pharmaceuticals Wastewater Contains High Concentration of Organic Matter, High Salt, and Other Suspended and Dissolved Solids

7.8 Others

7.8.1 Wastewater Generated From Other Industries is Highly Concentrated

8 Biological Wastewater Treatment Market, By Region (Page No. - 50)

8.1 Introduction

8.2 North America

8.2.1 US

8.2.1.1 Presence of Large Manufacturers and Rapidly Growing Meat & Poultry Industry are Driving the Market in the US

8.2.2 Canada

8.2.2.1 Growing Capital Expenditure and Development in Manufacturing Industries are Responsible for the Growth of the Market

8.2.3 Mexico

8.2.3.1 Increasing Foreign Investment in the Pulp & Paper Industry is Expected to Drive the Growth of the Market

8.3 Europe

8.3.1 Germany

8.3.1.1 Stringent Regulations on the Disposal of Wastewater is Driving the Market in Germany

8.3.2 France

8.3.2.1 Aging Infrastructure and Stringent Regulations are Expected to Drive the Market in the Country

8.3.3 UK

8.3.3.1 Technological Advancement and Stringent Regulations are Contributing to the Market Growth in the UK

8.3.4 Russia

8.3.4.1 Government Support for the Growth of the Paper and Plastic Industries is Contributing to the Market Growth

8.3.5 Italy

8.3.5.1 The Biological Wastewater Treatment Market in Italy is Driven By the Growth of Pulp & Paper Industry

8.3.6 Spain

8.3.6.1 Water Shortage and Stringent Regulations are Expected to Drive the Growth of the Market

8.3.7 Rest of Europe

8.3.7.1 Growth of Industries Including Paper and Plastics is Fueling the Biological Wastewater Treatment Market in This Region

8.4 Asia Pacific

8.4.1 Japan

8.4.1.1 Increasing Demand for Paper and Stringent Regulations are Driving the Market in Japan

8.4.2 China

8.4.2.1 Growth of Pulp & Paper Industry is Driving the Bwwt Market in China

8.4.3 India

8.4.3.1 Investments in the Manufacturing Industries are Expected to Drive the Growth of the Market

8.4.4 South Korea

8.4.4.1 Stringent Regulations and Industrialization are Expected to Boost the Biological Wastewater Treatment Market in South Korea

8.4.5 Australia

8.4.5.1 Stringent Regulations are Driving the Biological Wastewater Treatment Market in Australia

8.4.6 Rest of Asia Pacific

8.4.6.1 Government Investments in Various Manufacturing Industries and Stringent Regulations are Driving the Market in Rest of Apac

8.5 South America

8.5.1 Brazil

8.5.1.1 Stringent Regulations and Growing Pulp & Paper Industry are Major Drivers of the Market in Brazil

8.5.2 Argentina

8.5.2.1 Increasing Production of Paper and Stringent Regulations are Expected to Drive the Growth of the Market in Argentina

8.5.3 Rest of South America

8.5.3.1 Stringent Regulations and Water Scarcity are Major Drivers of the Market in This Region

8.6 Middle East & Africa

8.6.1 Saudi Arabia

8.6.1.1 Growth of Pulp & Paper Industry is Driving the Market in Saudi Arabia

8.6.2 UAE

8.6.2.1 Water Scarcity and Growth of Pulp & Paper Industry are Major Factors Responsible for the Growth of This Market

8.6.3 South Africa

8.6.3.1 Investment in Water Infrastructure is Expected to Drive the Market in South Africa

8.6.4 Rest of Middle East & Africa

8.6.4.1 Industrialization and Rising Population are Expected to Drive the Growth of the Market

9 Competitive Landscape (Page No. - 78)

9.1 Introduction

9.1.1 Visionaries

9.1.2 Innovators

9.1.3 Dynamic Differentiators

9.1.4 Emerging Companies

9.2 Strength of Product Portfolio

9.3 Business Strategy Excellence

9.4 Market Share of Key Players in the Market, 2019

10 Company Profiles (Page No. - 83)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, Winning Imperatives, Current Focus and Strategies, Threat From Competition, Right to Win)*

10.1 Veolia

10.2 Suez Water Technologies & Solutions

10.3 Evoqua Water Technologies LLC

10.4 Aquatech International

10.5 Xylem Inc.

10.6 Condorchem Envitech, S.L.

10.7 Ecolab Inc.

10.8 Pentair Plc

10.9 Samco Technologies, Inc.

10.10 DAS Environmental Expert GmbH

10.11 Other Key Players

10.11.1 Microvi Biotech, Inc.

10.11.2 Organica Water, Inc.

10.11.3 Dryden Aqua Ltd.

10.11.4 Wastewater Compliance Systems, Inc. (WCS)

10.11.5 Biokube

10.11.6 Aqwise

10.11.7 Bishop Water Technologies Inc.

10.11.8 Biogill

10.11.9 Bluetector AG

10.11.10 Huber SE

10.11.11 Entex Technologies

10.11.12 Tomorrow Water

10.11.13 RF Wastewater

10.11.14 Bluewater Bio Limited

10.11.15 Bioshaft Water Technology, Inc.

* Business Overview, Products Offered, Recent Developments, SWOT Analysis, Winning Imperatives, Current Focus and Strategies, Threat From Competition, Right to Win Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 121)

11.1 Insights of Industry Experts

11.2 Discussion Guide

11.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

11.4 Available Customizations

11.5 Related Reports

11.6 Author Details

List of Tables (53 Tables)

Table 1 Market Snapshot

Table 2 Wastewater Treatment Needs and Investments in the US

Table 3 Market, By Process, 2018–2025 (USD Million)

Table 4 Aerobic Biological Wastewater Treatment Market, By Region, 2018–2025 (USD Million)

Table 5 Anaerobic Market, By Region, 2018–2025 (USD Million)

Table 6 Market Size, By End-Use Industry, 2018–2025 (USD Million)

Table 7 Municipal Biological Wastewater Treatment Market, By Region, 2018—2025 (USD Million)

Table 8 Industrial Market, By Region, 2018—2025 (USD Million)

Table 9 Pulp & Paper: Biological Wastewater Treatment Market, By Region, 2018–2025 (USD Million)

Table 10 Market in Meat & Poultry Industry, By Region, 2018–2025 (USD Million)

Table 11 Chemicals: Biological Wastewater Treatment Market, By Region, 2018–2025 (USD Million)

Table 12 Pharmaceuticals: Market, By Region, 2018–2025 (USD Million)

Table 13 Others: Market, By Region, 2018–2025 (USD Million)

Table 14 Market Size, By Region, 2018–2025 (USD Million)

Table 15 Paper Production in North America

Table 16 North America: Market Size, By Country, 2018–2025 (USD Million)

Table 17 North America: Market Size, By Process, 2018–2025 (USD Million)

Table 18 North America: Market Size, By End-Use Industry, 2018–2025 (USD Million)

Table 19 US: Market, By End-Use Industry, 2018–2025 (USD Million)

Table 20 Canada: Market, By End-Use Industry, 2018–2025 (USD Million)

Table 21 Mexico: Market, By End-Use Industry, 2018–2025 (USD Million)

Table 22 Europe: Market Size, By Country, 2018–2025 (USD Million)

Table 23 Europe: Market Size, By Process, 2018–2025 (USD Million)

Table 24 Europe: Market Size, By End-Use Industry, 2018–2025 (USD Million)

Table 25 Germany: Market, By End-Use Industry, 2018–2025 (USD Million)

Table 26 France: Market, By End-Use Industry, 2018–2025 (USD Million)

Table 27 UK: Market, By End-Use Industry, 2018–2025 (USD Million)

Table 28 Russia: Market, By End-Use Industry, 2018–2025 (USD Million)

Table 29 Italy: Market, By End-Use Industry, 2018–2025 (USD Million)

Table 30 Spain: Market, By End-Use Industry, 2018–2025 (USD Million)

Table 31 Rest of Europe: Market, By End-Use Industry, 2018–2025 (USD Million)

Table 32 Asia Pacific: Market Size, By Country, 2018–2025 (USD Million)

Table 33 Asia Pacific: Market Size, By Process, 2018–2025 (USD Million)

Table 34 Asia Pacific: Market Size, By End-Use Industry, 2018–2025 (USD Million)

Table 35 Japan: Market Size, By End-Use Industry, 2018–2025 (USD Million)

Table 36 China: Market Size, By End-Use Industry, 2018–2025 (USD Million)

Table 37 India: Market Size, By End-Use Industry, 2018–2025 (USD Million)

Table 38 South Korea: Market Size, By End-Use Industry, 2018–2025 (USD Million)

Table 39 Australia: Market Size, By End-Use Industry, 2018–2025 (USD Million)

Table 40 Rest of Asia Pacific: Market Size, By End-Use Industry, 2018–2025 (USD Million)

Table 41 South America: Market Size, By Country, 2018–2025 (USD Million)

Table 42 South America: Market Size, By Process, 2018–2025 (USD Million)

Table 43 South America: Market Size, By End-Use Industry, 2018–2025 (USD Million)

Table 44 Brazil: Market Size, By End-Use Industry, 2018–2025 (USD Million)

Table 45 Argentina: Market Size, By End-Use Industry, 2018–2025 (USD Million)

Table 46 Rest of South America: Market Size, By End-Use Industry, 2018–2025 (USD Million)

Table 47 Middle East & Africa: Market Size, By Country, 2018–2025 (USD Million)

Table 48 Middle East & Africa: Market Size, By Process, 2018–2025 (USD Million)

Table 49 Middle East and Africa: Market Size, By End-Use Industry, 2018–2025 (USD Million)

Table 50 Saudi Arabia: Market Size, By End-Use Industry, 2018–2025 (USD Million)

Table 51 UAE: Market Size, By End-Use Industry, 2018–2025 (USD Million)

Table 52 South Africa: Market Size, By End-Use Industry, 2018–2025 (USD Million)

Table 53 Rest of Middle East & Africa: Market Size, By End-Use Industry, 2018–2025 (USD Million)

List of Figures (36 Figures)

Figure 1 Biological Wastewater Treatment Market Segmentation

Figure 2 Market: Bottom-Up Approach

Figure 3 Market: Top-Down Approach

Figure 4 Aerobic Segment Projected to Lead Biological Wastewater Treatment Market During Forecast Period

Figure 5 Industrial Segment Expected to Lead Market From 2020 to 2025

Figure 6 Stringent Regulations Regarding Disposal of Wastewater is One of the Key Factors Driving Biological Wastewater Treatment Market During Forecast Period

Figure 7 Municipal Segment Expected to Grow at A Higher CAGR During Forecast Period as Compared to Industrial Segment

Figure 8 Anaerobic Process Expected to Grow at A Higher CAGR During the Forecast Period

Figure 9 North America Accounted for the Largest Share of Biological Wastewater Treatment Market in 2019

Figure 10 Aerobic Segment and the US Led North America Market in 2019

Figure 11 Market: Drivers, Restraints, Opportunities & Challenges

Figure 12 Porter’s Five Forces Analysis for Biological Wastewater Treatment Market

Figure 13 Aerobic Process Segment Expected to Lead Market During Forecast Period

Figure 14 Industrial Segment Expected to Lead Biological Wastewater Treatment Market During Forecast Period

Figure 15 Market in Asia Pacific is Projected to Grow at the Highest CAGR From 2020 to 2025

Figure 16 North America Market Snapshot

Figure 17 Europe Market Snapshot

Figure 18 Asia Pacific Market Snapshot

Figure 19 South America Market Snapshot

Figure 20 Middle East & Africa Market Snapshot

Figure 21 Biological Wastewater Treatment Market Competitive Leadership Mapping, 2019

Figure 22 Veolia: Company Snapshot

Figure 23 Veolia: SWOT Analysis

Figure 24 Suez Water Technologies & Solutions: Company Snapshot

Figure 25 Suez Water Technologies & Solutions: SWOT Analysis

Figure 26 Evoqua Water Technologies LLC: Company Snapshot

Figure 27 Evoqua Water Technologies LLC: SWOT Analysis

Figure 28 Aquatech International: SWOT Analysis

Figure 29 Xylem Inc.: Company Snapshot

Figure 30 Xylem Inc.: SWOT Analysis

Figure 31 Condorchem Envitech, S.L.: SWOT Analysis

Figure 32 Ecolab Inc.: Company Snapshot

Figure 33 Ecolab Inc.: SWOT Analysis

Figure 34 Pentair Plc: Company Snapshot

Figure 35 Pentair Plc: SWOT Analysis

Figure 36 DAS Environmental Expert GmbH: SWOT Analysis

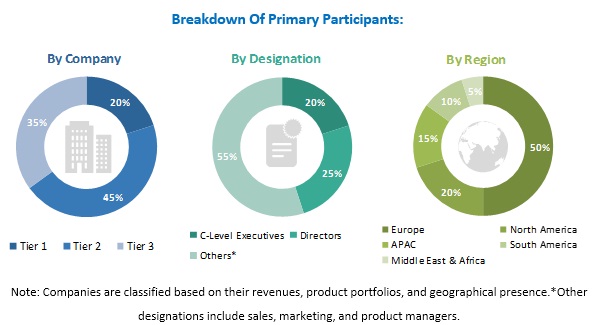

The study involved four major activities in estimating the current size of the biological wastewater treatment market. Exhaustive secondary research was undertaken to collect information on the market, peer markets, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both, the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, the National Rural Water Association (NRWA), the Global Water Intelligence (GWI), the National Association of Clean Water Agencies (NACWA), the National Environmental Services Center (NESC), the United Nations Educational, Scientific and Cultural Organization (UNESCO), and other sources were referred to identify and collect information for this study. Secondary sources include biological wastewater treatment manufacturers, annual reports, press releases & investor presentations of companies, whitepapers, certified publications, articles by recognized authors, gold standard & silver standard websites, associations, regulatory bodies, trade directories, and databases.

Primary Research

The biological wastewater treatment market comprises several stakeholders such as raw material suppliers, biological wastewater treatment manufacturers, OEMs in the pulp & paper, chemicals, meat & poultry, pharmaceutical industries, end product users, and regulatory organizations in the supply chain. The demand side of this market is characterized by the developments in the pulp & paper, chemicals, meat & poultry, pharmaceuticals, and other industries. The supply side is characterized by market consolidation activities undertaken by biological wastewater treatment producers. Several primary sources from both, the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation:

Both, the top-down and bottom-up approaches were used to estimate and validate the total size of the biological wastewater treatment market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and biological wastewater treatment market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation:

After arriving at the overall biological wastewater treatment market size-using the market size estimation process explained above-the market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both, the demand and supply sides.

Report Objectives:

- To analyze and forecast the size of the biological wastewater treatment market in terms of value

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the biological wastewater treatment market

- To define, describe, and forecast the market by process, end-use industry, and region

- To strategically analyze markets with respect to individual growth trends, prospects, and their contribution to the market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To strategically profile the key players and comprehensively analyze their market share and core competencies in the market.

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to the specific needs of companies. The following customization options are available for the report:

Regional Analysis

- A further breakdown of the regional biological wastewater treatment market to the country level by a process

Country Information

- Regional market split by major countries

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Growth opportunities and latent adjacency in Biological Wastewater Treatment Market

Need biological wastewater treatment market report by region