Aluminum Caps & Closures Market by Product Type (Roll-on pilfer-proof caps, Easy open end lids, Non-refillable closures), End-Use Sector (Beverage, Pharmaceutical, Food, Home & personal care), and Region - Global Forecast to 2025

Updated on : April 17, 2024

Aluminum Caps & Closures Market

The global aluminum caps & closures market was valued at USD 6.2 billion in 2020 and is projected to reach USD 7.6 billion by 2025, growing at a cagr 3.9% from 2020 to 2025. Increasing demand for convenience food, concerns about product safety and security, product differentiation and branding, and decreasing pack sizes are driving the market for aluminum caps & closures.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on global aluminum caps & closures market

The global aluminum caps & closures market is expected to witness a moderate decrease in its growth rate in 2020-2021, as the aluminum caps & closures used for home & personal care, automotive, and chemicals will witness a significant decline in its demand. However, there will be an increase in the demand for aluminum caps & closures in the food & beverage and pharmaceutical sectors during COVID-19.

- People are resorting to panic-buying and bulk stocking due to the fear of lockdowns. More people are ordering daily staples and fresh food through online channels, which leads to an increase in the demand for aluminum caps & closures. Governments of many affected countries, for instance, India, have asked the food industry players to ramp up production to avoid supply-side shocks and shortages and maintain uninterrupted supply. FMCG companies are responding by demanding more of these packaging products. For example, Britannia Industries has urged the Indian government to ensure interstate movements of suppliers of raw materials and packaging materials.

- The demand for aluminum caps & closures in the pharmaceutical industry is expected to remain robust as hospitals, drugs, and PPE manufacturers are responding to the crisis. The demand for household essentials, healthcare, and medical goods is not expected to decrease dramatically, and retail distribution for these types of products through online delivery can be expected to increase. This, in turn, boosts the demand for plastic caps & closures for the timely delivery of raw materials and finished goods to their respective end-users.

Aluminum Caps and Closures Market Dynamics

Driver: Need for convenience and concerns about product safety & security

Increasing demand for convenience food and better operability act as important drivers for aluminum caps & closures. A cap plays an imperative role in keeping the product fresh and safe from dust and other microbes. Consumers are on the lookout for closures that are user-friendly, easy to open, and convenient to use. The rising popularity of dispensing closures and pump closures in various product groups such as body care, skin care, beverages, and liquid food products is set to spur the growth of the aluminum caps & closures market globally.

The health and wellness trend is now shifting toward preventive healthcare, which is spurring the demand for FMCG products that target improved lifestyles. In a highly competitive market, illegal refilling of syrups & soft drinks and their counterfeiting pose a growing threat and a serious risk to human health, consumer confidence, and welfare. Caps that prevent contamination, tampering, and counterfeiting are becoming increasingly important to reassure consumers about the safety and authenticity of the products that they are buying.

Restraint: Development of substitutes

The aluminum caps & closures market is threatened by the growing usage of packs without closures such as pouch and blister packaging. Packs without closures offer various benefits to the packager, such as material cost reduction as compared to traditional methods of rigid packaging, sustainability issues, and others. The pouch packaging format is adopted by many FMCG companies as a packaging innovation tool to provide convenience to consumers. Many new easy open end lids and easy-reclose options are being added to the multitude of design possibilities across all end-user segments.

Plastic caps & closures restrain the growth of the aluminum caps & closures market. Innovations in the plastic closures segment continue to be of growing interest and hold great potential for development in the future. As a result, the gap between plastic and metal closures is expected to widen, with 52% of the market expected to be held by plastic closures in 2019. LDPE and HDPE are slowly taking up the place of polypropylene for various caps. Closure manufacturers are continuously reviewing and evaluating new materials and components, which can augment the range of closures and drive down their costs.

Opportunity: Emerging economies

Developing countries such as China, India, and Brazil are poised to witness high demand for aluminum caps & closures in the next few years. The growth is driven mainly by favorable demographics and a rise in household incomes. Convenience and hygiene are becoming highly valued attributes as packaged food products take up a growing share of the consumer’s expenditure due to changing lifestyles.

Other emerging economies such as Mexico, Turkey, South Africa, and Indonesia are promising markets for aluminum caps & closures due to the growing FMCG sector. Cap makers are adopting aggressive growth strategies in these nations by diversifying their product offering and strengthening their distribution base.

Challenge: Mature markets in developed regions

In developed economies such as the US and Western Europe, the per capita consumption of aluminum caps & closures is high, leaving limited further growth. The growing trend of consumption of healthy beverages, including juices and functional beverages among health-conscious consumers, has also led to the decline in the sales of carbonated soft drinks (CSDs) in a few mature markets. The demand for aluminum caps & closures is associated with packaged product sales at the retail front. The declining soft drink sales in the last five years have hampered the growth of the beverage packaging sector, which is the largest end user. In other industries, such as food and personal care, the penetration of packaged product sales is high.

The demand for aluminum caps & closures is relatively lower in developed markets due to the interdependency of the growth of the end-use sectors, especially in the beverage industry. Although improved consumption might drive this market in the next five years, this poses a challenge as the growth in consumption levels is expected to remain moderate.

The roll-on pilfer-proof segment is projected to be the fastest-growing product type in the market during the forecast period.

A roll-on pilfer-proof closure is a well-engineered product that is screwed on and off on a container. These closures contain either continuous threads or lugs. It must be engineered and designed to be cost-effective, compatible with contents, easy to open; provide an effective seal; and comply with the product, package, and environmental laws and regulations. In the beverages industry, aluminum caps & closures are tamper-resistant, which further helps tackle the issues of counterfeiting. A major factor in this expansion is supported by the fact that roll-on pilfer-proof caps combine the traditional decorating role of tamper-proof sealing and help retain the properties of packaged products.

Pharmaceutical to be a promising end-use sector of the aluminum caps & closures market.

It is very important to maintain the quality of pharmaceutical products during the manufacturing process. Pharmaceutical products can be contaminated through air particles, dust, and microorganisms. To avoid contamination, aluminum caps & closures are used to seal the medicines in the pharmaceutical industry. The packaging of healthcare products is of utmost importance to protect the contents from air, dust, and moisture. An increase in chronic ailments, an increase in the aging population, and a rise in disposable income in developing nations drive the demand for healthcare products, thereby driving the need for aluminum caps & closures.

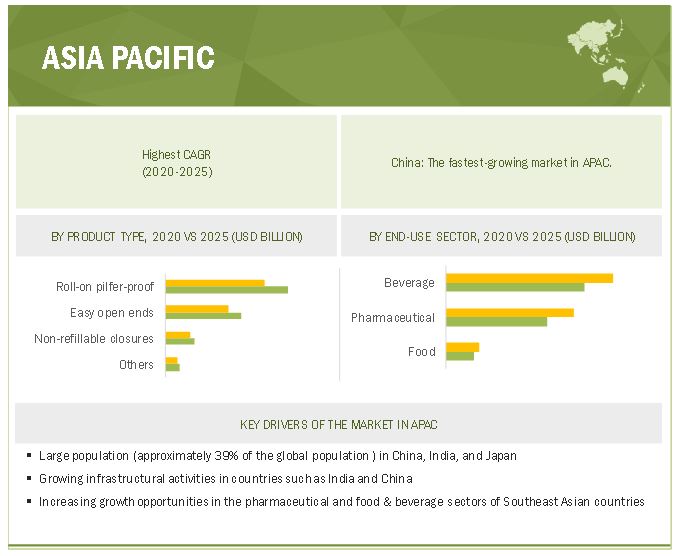

APAC is expected to account for the largest aluminum caps & closures market share during the forecast period, in terms of value

The APAC aluminum caps & closures market is segmented as China, Japan, India, South Korea, Australia, and the Rest of APAC. Moreover, APAC is projected to continue its dominance over the market until 2025. Increasing population, industrialization, and urbanization are augmenting the aluminum caps & closures market growth. China’s emergence as a global manufacturing hub has increased the demand for aluminum caps & closures. Cheap labor and easy availability of raw materials boost the production of these products in the region.

Aluminum Caps & Closures Market Players

Crown Holding (US),Silgan Holdings (US),>Amcor (Australia),Guala Closure (Luxembourg),Alcopack (Germany), Herti JSC (Bulgaria), Torrent Closures (Spain), Cap & Seal Pvt Ltd (India), and Federfin Tech S.R.L (Italy) are the leading players in the aluminum caps & closures market. Other players include Osias Berk (US), ITC Packaging (US), DYZDN Metal Packaging (China), Shangyu Sanyou Electro-Chemical Aluminium Products (China), Alameda Packaging (US), EMA Pharmaceuticals (France), Alupac-India (India), Alutop (India), Helicap Closures (China), and Manaksia Limited (India) are some of the players operating in the global aluminum caps & closures market.

Aluminum Caps & Closures Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2018–2025 |

|

Base year |

2018 |

|

Forecast period |

2020–2025 |

|

Units considered |

Value (USD Billion), Volume (Billion Units) |

|

Segments |

Product Type and End-use sector |

|

Regions |

North America, Europe, APAC, the Middle East & Africa, and South America |

|

Companies |

Crown Holdings, Inc. (US), Silgan Holdings. (US), Amcor (Australia), Guala Closure (Luxembourg), Alcopack (Germany), Herti JSC (Bulgaria), Torrent Closures (Spain), Cap & Seal Pvt Ltd (India), and Federfin Tech S.R.L (Italy) are the leading players in the aluminum caps & closures market. Other players include Osias Berk (US), ITC Packaging (US), DYZDN Metal Packaging (China), Shangyu Sanyou Electro-Chemical Aluminium Products (China), Alameda Packaging (US), EMA Pharmaceuticals (France), Alupac-India (India), Alutop (India), Helicap Closures (China), and Manaksia Limited (India) |

This research report categorizes the aluminum caps & closures market based on product type, end-use sector, and region.

Based on the product type:

- Roll-On-Pilfer-Proof

- Easy open ends

- Non-refillable closures

- Others (peel-off foils, lug caps, spout closures, and closure strips)

Based on the end-use sector:

- Beverage

- Pharmaceutical

- Food

- Home & personal care

- Others (automotive and chemical)

Based on the region:

- APAC

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In February 2018, Crown Food Europe, a subsidiary of Crown Holdings, introduced a new capping solutions package, which will help food manufacturers to lower the total cost of ownership. The package included the sale of its capping technology, ancillary components, and expert technical support for the machine’s service life. Three of Crown’s capping solutions—Smart Capper, Euro Capper, and Global Capper—were made available for sale as a part of this package.

- In June 2019, Amcor acquired Bemis Company Inc. The combined company will now operate as Amcor Plc (Amcor). The acquisition of Bemis has brought additional scale, capabilities, and footprint that has strengthened

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONAL SEGMENTATION

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 ALUMINUM CAPS & CLOSURES MARKET: INCLUSIONS AND EXCLUSIONS

1.4.1 INCLUSIONS

1.4.2 EXCLUSIONS

1.5 CURRENCY

1.6 UNIT CONSIDERED

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

2.1 RESEARCH DATA

FIGURE 1 ALUMINUM CAPS & CLOSURES MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

FIGURE 2 MARKET SIZE ESTIMATION: ALUMINUM CAPS & CLOSURES MARKET

FIGURE 3 ALUMINUM CAPS & CLOSURES MARKET, BY REGION

FIGURE 4 ALUMINUM CAPS & CLOSURES MARKET, BY PRODUCT TYPE

FIGURE 5 MARKET SIZE ESTIMATION: BY END-USE SECTOR

2.2.1 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.2.2 BOTTOM-UP APPROACH

FIGURE 7 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.3 ASSUMPTIONS

2.4 LIMITATIONS

2.5 DATA TRIANGULATION

FIGURE 8 ALUMINUM CAPS & CLOSURES MARKET: DATA TRIANGULATION

3 EXECUTIVE SUMMARY

FIGURE 9 ROLL-ON PILFER-PROOF SEGMENT TO DOMINATE THE MARKET THROUGH 2025

FIGURE 10 PHARMACEUTICAL TO BE THE LARGEST END-USE SECTOR IN THE NEXT FIVE YEARS

FIGURE 11 APAC TO REMAIN THE LARGEST MARKET FOR ALUMINUM CAPS & CLOSURES

4 PREMIUM INSIGHTS

4.1 ATTRACTIVE OPPORTUNITIES IN THE ALUMINUM CAPS & CLOSURES MARKET

FIGURE 12 EMERGING ECONOMIES TO OFFER LUCRATIVE GROWTH OPPORTUNITIES FOR THE MARKET PLAYERS

4.2 ALUMINUM CAPS & CLOSURES MARKET, BY PRODUCT TYPE

FIGURE 13 ROLL-ON PILFER-PROOF CAPS TO GROW AT THE HIGHEST CAGR

4.3 ALUMINUM CAPS & CLOSURES MARKET, BY END-USE SECTOR

FIGURE 14 BEVERAGE SECTOR WAS THE LARGEST SEGMENT IN 2020

4.4 ALUMINUM CAPS & CLOSURES MARKET, BY COUNTRY

FIGURE 15 ALUMINUM CAPS & CLOSURES MARKET IN DEVELOPING COUNTRIES TO GROW AT A FASTER RATE THAN IN DEVELOPED COUNTRIES

4.5 APAC: ALUMINUM CAPS & CLOSURES MARKET

FIGURE 16 CHINA TO LEAD THE ALUMINUM CAPS & CLOSURES MARKET IN APAC

4.6 ALUMINUM CAPS & CLOSURES MARKET: REGIONAL GROWTH RATES

FIGURE 17 CHINA TO REGISTER THE HIGHEST CAGR, FOLLOWED BY INDIA

5 MARKET OVERVIEW

5.1 INTRODUCTION

5.2 VALUE CHAIN ANALYSIS

FIGURE 18 ALUMINUM CAPS & CLOSURES VALUE CHAIN

5.3 MARKET DYNAMICS

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE ALUMINUM CAPS & CLOSURES MARKET

5.3.1 DRIVERS

5.3.1.1 Increasing demand for convenience food

5.3.1.2 Concerns about product safety and security

5.3.1.3 Product differentiation and branding

5.3.1.4 Decreasing pack sizes

5.3.2 RESTRAINTS

5.3.2.1 Development of substitutes

5.3.3 OPPORTUNITIES

5.3.3.1 Emerging economies

5.3.4 CHALLENGES

5.3.4.1 Matured markets

5.4 PORTER’S FIVE FORCES ANALYSIS

FIGURE 20 PORTER’S FIVE FORCES ANALYSIS

5.4.1 THREAT OF NEW ENTRANTS

5.4.2 THREAT OF SUBSTITUTES

5.4.3 BARGAINING POWER OF SUPPLIERS

5.4.4 BARGAINING POWER OF BUYERS

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

5.5 MACROECONOMIC INDICATORS

5.5.1 INTRODUCTION

5.5.2 RISE IN DISPOSABLE INCOME

5.5.3 INCREASE IN MIDDLE-CLASS POPULATION

5.5.4 INCREASE IN GDP OF EMERGING ECONOMIES

TABLE 1 TREND AND FORECAST OF NOMINAL GDP, BY COUNTRY, 2015–2022 (USD BILLION)

5.6 COVID-19 IMPACT ON ALUMINUM CAPS & CLOSURES MARKET

5.6.1 IMPACT OF COVID-19 ON END-USE SECTORS OF ALUMINUM CAPS & CLOSURES

5.6.1.2 Impact of COVID-19 on the pharmaceutical industry

5.6.1.3 Impact of COVID-19 on the home & personal care industry

5.6.2 IMPACT OF COVID-19 ON VARIOUS COUNTRIES

6 ALUMINUM CAPS & CLOSURES MARKET, BY PRODUCT TYPE

6.1 INTRODUCTION

FIGURE 21 ROLL-ON PILFER-PROOF CAPS TO BE THE MOST DOMINANT SEGMENT OF ALUMINUM CAPS & CLOSURES MARKET IN 2020

TABLE 2 ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD BILLION)

TABLE 3 ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (BILLION UNIT)

6.1.1 ROLL-ON PILFER-PROOF (ROPP) CAPS

6.1.2 EASY OPEN END LIDS

6.1.3 NON-REFILLABLE CLOSURES

6.1.4 OTHERS

7 ALUMINUM CAPS & CLOSURES MARKET, BY END-USE SECTOR

7.1 INTRODUCTION

FIGURE 22 BEVERAGE SEGMENT TO DOMINATE THE ALUMINUM CAPS & CLOSURES MARKET THROUGH 2025

TABLE 4 ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD BILLION)

TABLE 5 ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (BILLION UNIT)

7.2 BEVERAGE

7.3 FOOD

7.4 PHARMACEUTICAL

7.5 HOME & PERSONAL CARE

7.6 OTHERS

8 ALUMINUM CAPS & CLOSURES MARKET, BY REGION

8.1 INTRODUCTION

FIGURE 23 CHINA AND INDIA TO REGISTER HIGH GROWTH RATES, 2020–2025

TABLE 6 ALUMINUM CAPS & CLOSURES MARKET SIZE, BY REGION, 2018–2025 (USD BILLION)

TABLE 7 ALUMINUM CAPS & CLOSURES MARKET SIZE, BY REGION, 2018–2025 (BILLION UNIT)

8.2 APAC

FIGURE 24 APAC: ALUMINUM CAPS & CLOSURES MARKET SNAPSHOT

TABLE 8 APAC: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY COUNTRY, 2018–2025 (USD BILLION)

TABLE 9 APAC: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY COUNTRY, 2018–2025 (BILLION UNIT)

TABLE 10 APAC: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD BILLION)

TABLE 11 APAC: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (BILLION UNIT)

TABLE 12 APAC: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD BILLION)

TABLE 13 APAC: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (BILLION UNIT)

8.2.1 CHINA

8.2.1.1 Rising demand for ready-to-eat foods, carbonated drinks, and medical emergencies due to COVID-19 offering growth opportunities

TABLE 14 CHINA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD BILLION)

TABLE 15 CHINA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (BILLION UNIT)

TABLE 16 CHINA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD BILLION)

TABLE 17 CHINA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (BILLION UNIT)

8.2.2 INDIA

8.2.2.1 Rise in demand due to the growth of beverage and pharmaceutical sectors

TABLE 18 INDIA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD BILLION)

TABLE 19 INDIA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (BILLION UNIT)

TABLE 20 INDIA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD BILLION)

TABLE 21 INDIA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (BILLION UNIT)

8.2.3 JAPAN

8.2.3.1 Increase in demand for high-quality healthcare products to drive the market

the market 64

TABLE 22 JAPAN: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD BILLION)

TABLE 23 JAPAN: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (BILLION UNIT)

TABLE 24 JAPAN: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD BILLION)

TABLE 25 JAPAN: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (BILLION UNIT)

8.2.4 SOUTH KOREA

8.2.4.1 Increasing demand for packaged food to drive the market

TABLE 26 SOUTH KOREA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD BILLION)

TABLE 27 SOUTH KOREA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (BILLION UNIT)

TABLE 28 SOUTH KOREA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD BILLION)

TABLE 29 SOUTH KOREA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (BILLION UNIT)

8.2.5 AUSTRALIA

8.2.5.1 Shift toward convenient, safe, and sustainable packaging to drive the market

the market 67

TABLE 30 AUSTRALIA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD BILLION)

TABLE 31 AUSTRALIA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (BILLION UNIT)

TABLE 32 AUSTRALIA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD BILLION)

TABLE 33 AUSTRALIA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (BILLION UNIT)

8.2.6 REST OF APAC

TABLE 34 REST OF APAC: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD BILLION)

TABLE 35 REST OF APAC: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (BILLION UNIT)

TABLE 36 REST OF APAC: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD BILLION)

TABLE 37 REST OF APAC: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (BILLION UNIT)

8.3 EUROPE

FIGURE 25 ROLL-ON PILFER-PROOF SEGMENT ACCOUNTS FOR THE LARGEST MARKET SHARE IN EUROPE

TABLE 38 EUROPE: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY COUNTRY, 2018–2025 (USD BILLION)

TABLE 39 EUROPE: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY COUNTRY, 2018–2025 (BILLION UNIT)

TABLE 40 EUROPE: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD BILLION)

TABLE 41 EUROPE: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (BILLION UNIT)

TABLE 42 EUROPE: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD BILLION)

TABLE 43 EUROPE: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (BILLION UNIT)

8.3.1 GERMANY

8.3.1.1 Rise in domestic consumer and international demand will drive the packaging industry

TABLE 44 GERMANY: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD BILLION)

TABLE 45 GERMANY: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (BILLION UNIT)

TABLE 46 GERMANY: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD BILLION)

TABLE 47 GERMANY: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (BILLION UNIT)

8.3.2 UK

8.3.2.1 Rising food exports and demand for convenience food offering growth opportunities

TABLE 48 UK: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD BILLION)

TABLE 49 UK: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (BILLION UNIT)

TABLE 50 UK: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD BILLION)

TABLE 51 UK: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (BILLION UNIT)

8.3.3 RUSSIA

8.3.3.1 Increasing demand for carbonated and non-carbonated drinks to drive the demand

TABLE 52 RUSSIA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD BILLION)

TABLE 53 RUSSIA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (BILLION UNIT)

TABLE 54 RUSSIA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD BILLION)

TABLE 55 RUSSIA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (BILLION UNIT)

8.3.4 FRANCE

8.3.4.1 Rising demand for aluminum caps & closures from the pharmaceutical sector

TABLE 56 FRANCE: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD BILLION)

TABLE 57 FRANCE: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (BILLION UNIT)

TABLE 58 FRANCE: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD BILLION)

TABLE 59 FRANCE: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (BILLION UNIT)

8.3.5 ITALY

8.3.5.1 Rising demand for pharmaceutical products boosting market growth

TABLE 60 ITALY: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD BILLION)

TABLE 61 ITALY: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (BILLION UNIT)

TABLE 62 ITALY: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD BILLION)

TABLE 63 ITALY: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (BILLION UNIT)

8.3.6 REST OF EUROPE

TABLE 64 REST OF EUROPE: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD BILLION)

TABLE 65 REST OF EUROPE: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (BILLION UNIT)

TABLE 66 REST OF EUROPE: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD BILLION)

TABLE 67 REST OF EUROPE: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (BILLION UNIT)

8.4 NORTH AMERICA

FIGURE 26 NORTH AMERICA: ALUMINUM CAPS & CLOSURES MARKET SNAPSHOT

TABLE 68 NORTH AMERICA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY COUNTRY, 2018–2025 (USD BILLION)

TABLE 69 NORTH AMERICA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY COUNTRY, 2018–2025 (BILLION UNIT)

TABLE 70 NORTH AMERICA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD BILLION)

TABLE 71 NORTH AMERICA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (BILLION UNIT)

TABLE 72 NORTH AMERICA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD BILLION)

TABLE 73 NORTH AMERICA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (BILLION UNIT)

8.4.1 US

8.4.1.1 Increased focus on convenient packaging for attracting customers to drive the market

TABLE 74 US: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD BILLION)

TABLE 75 US: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (BILLION UNIT)

TABLE 76 US: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD BILLION)

TABLE 77 US: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (BILLION UNIT)

8.4.2 CANADA

8.4.2.1 Increase in demand for convenient packaging to drive the market

TABLE 78 CANADA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD BILLION)

TABLE 79 CANADA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (BILLION UNIT)

TABLE 80 CANADA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD BILLION)

TABLE 81 CANADA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (BILLION UNIT)

8.4.3 MEXICO

8.4.3.1 High growth potential of packaging industry due to increasing disposable income and rising population

TABLE 82 MEXICO: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD BILLION)

TABLE 83 MEXICO: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (BILLION UNIT)

TABLE 84 MEXICO: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD BILLION)

TABLE 85 MEXICO: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (BILLION UNIT)

8.5 SOUTH AMERICA

FIGURE 27 RAPID INDUSTRIALIZATION TO DRIVE THE ALUMINUM CAPS & CLOSURES MARKET IN SOUTH AMERICA

TABLE 86 SOUTH AMERICA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY COUNTRY, 2018–2025 (USD BILLION)

TABLE 87 SOUTH AMERICA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY COUNTRY, 2018–2025 (BILLION UNIT)

TABLE 88 SOUTH AMERICA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD BILLION)

TABLE 89 SOUTH AMERICA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (BILLION UNIT)

TABLE 90 SOUTH AMERICA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD BILLION)

TABLE 91 SOUTH AMERICA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (BILLION UNIT)

8.5.1 BRAZIL

8.5.1.1 Rise in awareness regarding healthcare issues and robust investment in the healthcare industry to drive the market

TABLE 92 BRAZIL: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD BILLION)

TABLE 93 BRAZIL: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (BILLION UNIT)

TABLE 94 BRAZIL: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD BILLION)

TABLE 95 BRAZIL: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (BILLION UNIT)

8.5.2 ARGENTINA

8.5.2.1 Government initiatives for ease of doing business and growing economy are supporting market growth

TABLE 96 ARGENTINA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD BILLION)

TABLE 97 ARGENTINA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (BILLION UNIT)

TABLE 98 ARGENTINA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD BILLION)

TABLE 99 ARGENTINA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (BILLION UNIT)

8.5.3 REST OF SOUTH AMERICA

TABLE 100 REST OF SOUTH AMERICA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD BILLION)

TABLE 101 REST OF SOUTH AMERICA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (BILLION UNIT)

TABLE 102 REST OF SOUTH AMERICA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD BILLION)

TABLE 103 REST OF SOUTH AMERICA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (BILLION UNIT)

8.6 MIDDLE EAST & AFRICA

FIGURE 28 TURKEY TO ACCOUNT FOR THE LARGEST MARKET SHARE IN THE MIDDLE EAST & AFRICA

TABLE 104 MIDDLE EAST & AFRICA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY COUNTRY, 2018–2025 (USD BILLION)

TABLE 105 MIDDLE EAST & AFRICA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY COUNTRY, 2018–2025 (BILLION UNIT)

TABLE 106 MIDDLE EAST & AFRICA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD BILLION)

TABLE 107 MIDDLE EAST & AFRICA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (BILLION UNIT)

TABLE 108 MIDDLE EAST & AFRICA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD BILLION)

TABLE 109 MIDDLE EAST & AFRICA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (BILLION UNIT)

8.6.1 TURKEY

8.6.1.1 Development of the packaging industry to drive the market

TABLE 110 TURKEY: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD BILLION)

TABLE 111 TURKEY: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (BILLION UNIT)

TABLE 112 TURKEY: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD BILLION)

TABLE 113 TURKEY: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (BILLION UNIT)

8.6.2 UAE

8.6.2.1 Rising beverage and pharmaceutical sectors to fuel the demand

TABLE 114 UAE: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD BILLION)

TABLE 115 UAE: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (BILLION UNIT)

TABLE 116 UAE: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD BILLION)

TABLE 117 UAE: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (BILLION UNIT)

8.6.3 SOUTH AFRICA

8.6.3.1 Changes in lifestyle and increase in consumption of packaged food to drive the demand

TABLE 118 SOUTH AFRICA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD BILLION)

TABLE 119 SOUTH AFRICA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (BILLION UNIT)

TABLE 120 SOUTH AFRICA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD BILLION)

TABLE 121 SOUTH AFRICA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (BILLION UNIT)

8.6.4 REST OF MIDDLE EAST & AFRICA

TABLE 122 REST OF MIDDLE EAST & AFRICA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD BILLION)

TABLE 123 REST OF MIDDLE EAST & AFRICA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (BILLION UNIT)

TABLE 124 REST OF MIDDLE EAST & AFRICA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD BILLION)

TABLE 125 REST OF MIDDLE EAST & AFRICA: ALUMINUM CAPS & CLOSURES MARKET SIZE, BY END-USE SECTOR, 2018–2025 (BILLION UNIT)

9 COMPETITIVE LANDSCAPE

9.1 INTRODUCTION

FIGURE 29 INVESTMENT & EXPANSION AND MERGER & ACQUISITION WERE THE KEY GROWTH STRATEGIES ADOPTED BETWEEN 2015 AND 2020

9.2 COMPETITIVE LEADERSHIP MAPPING

9.2.1 STAR

9.2.2 EMERGING LEADERS

9.2.3 PERVASIVE

9.2.4 EMERGING COMPANIES

FIGURE 30 ALUMINUM CAPS & CLOSURES MARKET: COMPETITIVE LEADERSHIP MAPPING, 2019

9.3 STRENGTH OF PRODUCT PORTFOLIO

9.4 BUSINESS STRATEGY EXCELLENCE

9.5 COMPETITIVE LEADERSHIP MAPPING (SMALL AND MEDIUM-SIZED ENTERPRISES)

9.5.1 PROGRESSIVE COMPANIES

9.5.2 RESPONSIVE COMPANIES

9.5.3 DYNAMIC COMPANIES

9.5.4 STARTING BLOCKS

FIGURE 31 ALUMINUM CAPS & CLOSURES MARKET (SMALL AND MEDIUM-SIZED ENTERPRISES) COMPETITIVE LEADERSHIP MAPPING, 2019

9.6 STRENGTH OF PRODUCT PORTFOLIO

9.7 BUSINESS STRATEGY EXCELLENCE

9.8 MARKET RANKING OF KEY PLAYERS

FIGURE 32 MARKET RANKING

9.9 COMPETITIVE SCENARIO

9.9.1 EXPANSIONS & INVESTMENTS

TABLE 126 EXPANSIONS & INVESTMENTS, 2015–2020

9.9.2 MERGERS & ACQUISITIONS

TABLE 127 MERGERS & ACQUISITIONS, 2015–2020

9.9.3 CONTRACTS & AGREEMENTS, STRATEGIC ALLIANCES

TABLE 128 CONTRACTS & AGREEMENTS AND STRATEGIC ALLIANCES, 2015–2020

9.9.4 NEW PRODUCT LAUNCHES/DEVELOPMENTS

TABLE 129 NEW PRODUCT LAUNCHES/DEVELOPMENTS, 2015–2020

10 COMPANY PROFILES

(Business overview, Products offered, Recent developments, SWOT analysis & MnM View)*

10.1 CROWN HOLDINGS, INC.

FIGURE 33 CROWN HOLDINGS: COMPANY SNAPSHOT

10.2 SILGAN HOLDINGS

FIGURE 34 SILGAN HOLDINGS: COMPANY SNAPSHOT

10.3 AMCOR PLC

FIGURE 35 AMCOR: COMPANY SNAPSHOT

10.4 GUALA CLOSURES S.P.A

FIGURE 36 GUALA CLOSURES S.P.A: COMPANY SNAPSHOT

10.5 ALCOPACK GROUP

10.6 HERTI JSC

10.7 TORRENT CLOSURES

10.8 FEDERFIN TECH S.R.L.

*Details on Business overview, Products offered, Recent developments, SWOT analysis & MnM View might not be captured in case of unlisted companies.

10.9 ADDITIONAL COMPANIES

10.9.1 OSIAS BERK COMPANY

10.9.2 ITC PACKAGING

10.9.3 DYZDN METAL PACKAGING

10.9.4 SHANGYU SANYOU ELECTRO-CHEMICAL ALUMINUM PRODUCTS

10.9.5 ALAMEDA PACKAGING

10.9.6 EMA PHARMACEUTICALS

10.9.7 CAP & SEAL PVT. LTD

10.9.8 J.G. FINNERAN ASSOCIATES

10.9.9 ALUPAC INDIA

10.9.10 HICAP CLOSURES

10.9.11 ALUTOP

10.9.12 MANAKSIA LIMITED

10.9.13 MJS PACKAGING

10.9.14 INTEGRATED CAPS

10.9.15 GLOBAL CLOSURE SYSTEMS

10.9.16 KGS & CO

11 APPENDIX

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.3 AVAILABLE CUSTOMIZATIONS

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the aluminum caps & closures market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and subsegments of the overall market.

Secondary Research

This research report involves extensive secondary sources, directories, and databases, such as Bloomberg, BusinessWeek, Factiva, ICIS, and OneSource, to identify and collect information useful for the technical, market-oriented, and commercial study of the aluminum caps & closures market. The secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, and articles from recognized authors, authenticated directories, and databases.

Primary Research

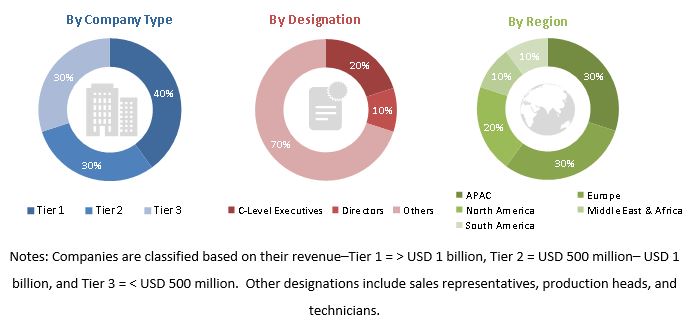

The aluminum caps & closures market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, buyers, and regulatory organizations. The demand side of this market is characterized by developing the end-use sector, such as beverage, pharmaceutical, food, home & personal care, and others. The supply side included industry experts, such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the aluminum caps & closures market. These methods were also used extensively to estimate the sizes of various subsegments in the market. The research methodology used to estimate the market size includes the following steps:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the estimation processes explained above-the aluminum caps & closures market was split into several segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To analyze and forecast the aluminum caps & closures market, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the aluminum caps & closures market

- To analyze and forecast the size of the market based on product type, and end-use sector

- To estimate and forecast the market size based on five regions, namely, North America, Europe, Asia Pacific (APAC), the Middle East & Africa, and South America

- To analyze the market opportunities and competitive landscape of the market leaders and stakeholders

- To analyze the competitive developments, such as merger & acquisition, investment & expansion, new product launch/development, and partnerships, contracts & agreements in the aluminum caps & closures market

- To strategically identify and profile the key market players and analyze their core competencies

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the aluminum caps & closures market report:

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company

Regional Analysis

- A further breakdown of the aluminum caps & closures market, by segments

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Aluminum Caps & Closures Market